Korean-American banks in Southern California posted sluggish profits in the fourth quarter amid tough business conditions but managed to maintain their assets, deposits, and loans. With the Federal Reserve (Fed) continuing to hint at a possible interest rate cut later this year, it remains to be seen if the banks will be able to improve their profitability in the coming quarters.

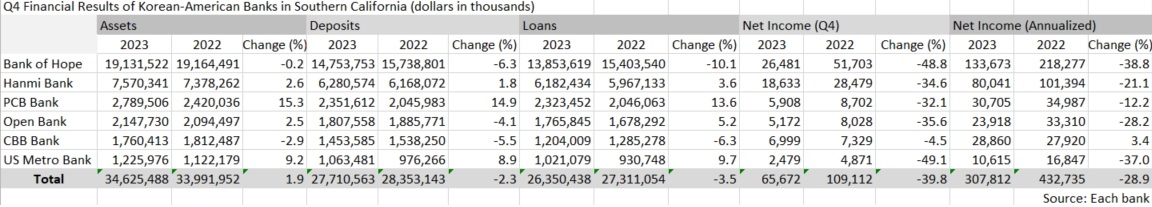

When analyzing the 2023 operating results of six Korean-American banks headquartered in Southern California – Bank of Hope, Hanmi Bank, PCB Bank, Open Bank, CBB Bank, and US Metro Bank – the total net income for the fourth quarter came to $65.67 million, while the total annualized net income was $307.8 million.

Net income

Net income for the six Southern California Korean-American banks in Q4 2023 decreased 39.8% compared to $109.1 million in Q4 last year. All six banks reported lower net income in the fourth quarter compared to the same period last year. Five of the six banks saw double-digit declines in net income.

Total annualized net income also declined. The six banks posted a net income of $307.8 million last year. That’s 28.9% less than the year before when the net amounted to $432.7 million. However, CBB Bank stood out with a 3.4% increase in annual net income.

Bank of Hope reported a net income with a steep decline from last year’s, but the bank noted that this includes payment to the Federal Deposit Insurance Corporation (FDIC) of Special assessment, which requested the banks over certain asset size to pay to recover drained insurance budget from when multiple regional banks collapsed last year in March, in addition to the cost from an organizational restructuring last October.

Assets, Loans, and Deposits

As of 2023, these banks reported total assets of $34.6 billion, up more than $600 million from last year. However, it was down slightly from the previous quarter. Four out of six banks posted asset growth, while the steepest asset growth among these banks was PCB Bank, which saw its assets grow 15.3% year-over-year last year. U.S. Metrobank also had a near double-digit increase, up 9.2%.

Total loans fell 3.5% to $26.3 billion, compared to $27.3 billion last year. However, four out of six banks saw year-over-year loan growth, with PCB Bank posting a 13.6% increase in loans and US Metro Bank posting a 9.7% increase. Hanmi Bank and Open Bank also increased their loan volume by 3.6% and 5.2%, respectively.

Six Korean-American banks’ total deposits decreased by 2.3% to $27.7 billion from $28.3 billion a year earlier. Except for Hanmi Bank (+1.8%), PCB Bank (+14.9%), and US Metro Bank (+8.9%), three banks saw their deposits decline.

The Korean-American banking professionals saw the decline in profitability as a result of the steep increase in the benchmark interest rate last year and the deterioration of business conditions due to the financial turmoil triggered by the bankruptcies of Silicon Valley Bank (SVB) and Signature Bank last year.

“It is difficult to see a significant improvement in the business environment of banks in the first half of this year unless a significant rate cut is made in the short term,” said a Korean-American bank official.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]