A new report reveals that 35% of California households—more than 3.8 million—are unable to meet basic living expenses, sparking concerns over deepening economic hardship across the state. The estimate is based on a typical household model of four people: two adults, one toddler, and one elementary school-aged child.

Report Highlights Living Cost Gap

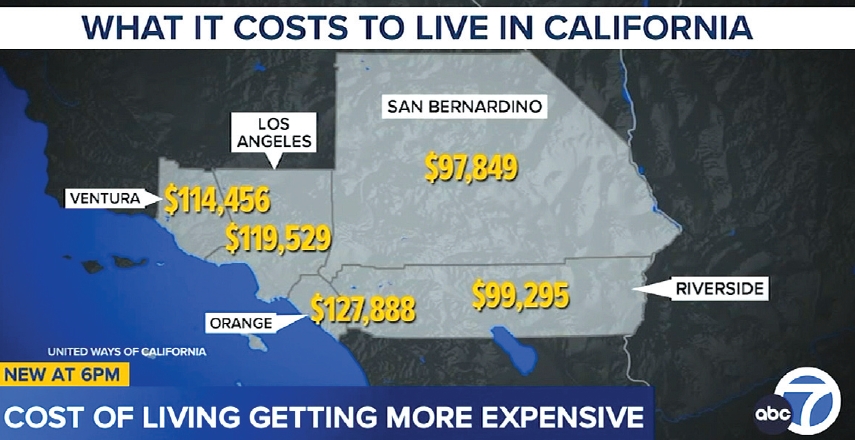

The study, published by United Way California, outlines the real cost of living for this four-person family as approximately $100,000 annually. However, the average income for the 3.8 million struggling households is only $40,911, falling short by more than $50,000.

Surveying all 58 counties in California, the report breaks down average annual expenses as follows:

-

Housing: $21,012

-

Child care: $16,728

-

Transportation: $13,992

-

Healthcare: $11,554

-

Taxes: $14,373

-

Food: $13,968

-

Miscellaneous: $7,728

This totals an average of $99,295 needed per year. By contrast, the average household earns $46,230, which, after tax credits of about $2,884, brings the net to $49,114—still $50,181 short of meeting essential costs.

In Los Angeles County, the gap is even wider. Households require $119,529 annually to maintain basic living standards, leaving a shortfall of over $70,000.

Why Real Cost of Living Matters

The report emphasizes that these figures differ from the federal poverty line, which is based on national averages and fails to reflect high-cost states like California. The findings highlight the growing disconnect between official poverty measures and the actual expenses required for survival.

Experts Warn of Risks

Elise Buik, CEO of United Way of Greater Los Angeles, warned, “One unexpected event—such as a car repair, medical bill, or rent hike—could push these 3.8 million households into homelessness.”

One example cited in the report is Ivonne Sonato-Vegas, a mother of five who described near collapse under the burden of child care and health insurance costs. She said, “You have to work full-time to qualify for family health insurance. Medi-Cal cuts off based on income, and private insurance costs $600 to $1,200 a month, which is impossible for us.”

Conditions May Be Worse Now

The report used data current as of October 2023 and noted that recent interest rate hikes and inflation were not factored in, suggesting that the economic situation may have worsened since.

Calls for Policy Response

Pete Manzo, CEO of United Way California, urged swift action, saying, “Public assistance is shrinking, and working families urgently need policy solutions.” He advocated for expanding the child tax credit and introducing housing incentives for low-income families.

Nonprofits Face Funding Strains

Nonprofits are also feeling the impact of the economic squeeze. Carolyn Fajardo, CEO of Feeding America, noted, “Even long-time donors are scaling back or delaying support. Demand remains high, but funding is drying up.”

Invisible Poverty Growing Post-Pandemic

The report concludes that post-pandemic economic stagnation and high inflation are fueling the rise of what it calls California’s “invisible poor,” and stresses that proactive measures are essential to prevent further deterioration.

BY BRIAN CHOI [ichoi@koreadaily.com]

![Troublesome delivery robots damage gardens, snarl streets Delivery robots in urban areas including LA Koreatown and Hollywood have been involved in a string of incidents, blocking fire engine responses, crossing police lines at active scenes, and colliding with homes and motorcycles. [KTLA • Reddit capture]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0226-delivery-robot-compile-100x70.jpg)

![Nonprofit leaders accused of diverting millions meant for the vulnerable Judy Baca, who faces allegations of embezzling $5 million, participates in work on “The Great Wall of Los Angeles” mural in 2023. [Sangjin Kim, The Korea Daily]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0226-nonprofit-1-100x70.jpg)

![Family of army veteran killed in San Antonio shooting launches fundraiser A screenshot of the GoFundMe fundraising page created for Kyung Chang Lee. Donations are being collected to support the family of Lee, who was killed in the San Antonio, Texas, shooting. [GoFundMe capture]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0225-KyungChangLee-100x70.jpg)

![Cartel leader’s killing sparks unrest, prompts Koreans to reconsider Mexico trips Downtown Guadalajara in Mexico’s state of Jalisco, which resembled a war zone on February 22 amid arson and other violence by drug cartel members, appears quiet on February 24. The area, usually crowded with tourists and residents, saw a sharp decline in foot traffic and public transportation use. [Pablo Lemus Navarro/X account]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0225-Mexico-100x70.jpg)