By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

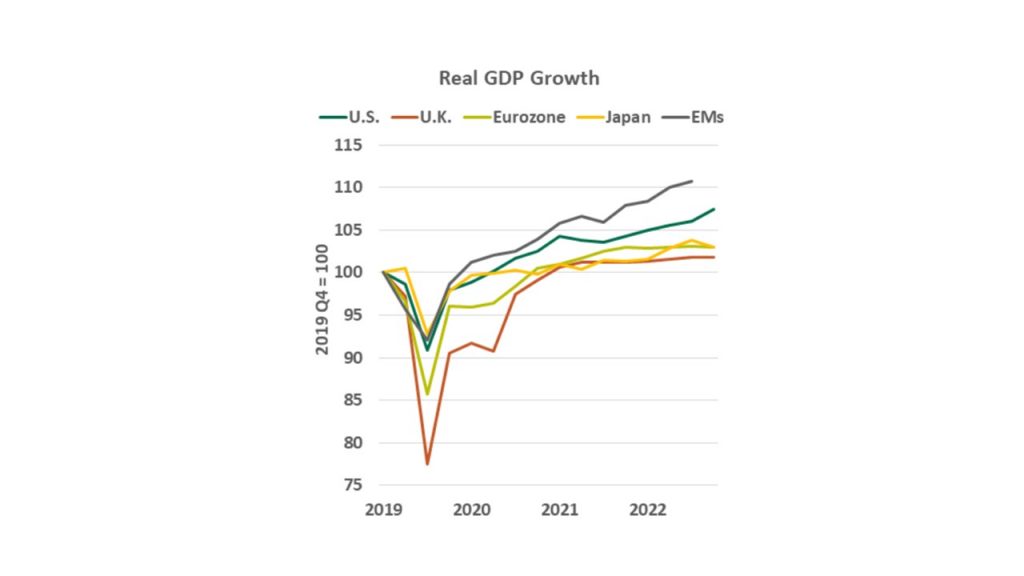

In 2023, despite facing numerous challenges such as increasing interest rates, high inflation, and geopolitical instability, the global economy avoided a recession. The market is now anticipating that the Federal Reserve will start reducing interest rates in 2024, which has led to a decrease in the value of the U.S. dollar, influencing economies worldwide.

Looking ahead to 2024, the pace of global economic growth is expected to slow down. This raises critical questions: Will this slowdown lead to a worldwide recession? Which countries will perform relatively better or worse in a low-growth environment? The answers to these questions are crucial for global investors to determine their next moves.

In the developed world, investing in the Eurozone and the U.K. can be risky. These regions have been slower to reduce inflation compared to the U.S. The European Central Bank is likely to be more cautious than its American counterpart in cutting the interest rate. In the U.K., the inflation situation is even more challenging, making it likely that the Bank of England will be hesitant to reduce the interest rate significantly. A recession in the U.K. is a definite possibility.

In contrast, while the G10 countries’ economic growth is expected to remain near a recessionary level of about 1%, emerging market (EM) economies might grow at a much faster rate of 3.5 to 4.0 percent in 2024. However, within the EM category, there will be variations in performance.

China, once a locomotive of global economic growth, is now facing slowdowns. In recent years, China’s annual growth rate has decreased from around 8% to an estimated 4 to 4.5%. The country is grappling with both short-term and long-term challenges, including the global trend towards deglobalization and trade fragmentation, an aging population, a heavily leveraged real estate sector, slowing consumer spending, potential deflation, and strained relations with the U.S.

As China’s economic influence wanes, several Southeast Asian countries, including India, Vietnam, the Philippines, and Thailand, are emerging as new economic hot spots. Many factories are relocating from China to these countries, resulting in a surge in their exports and foreign exchange reserves.

Among these countries, India is showing a significant potential to become a new engine of global economic growth, thanks to the abundance of both skilled and unskilled workforce. India’s Central Bank has not increased the interest rate to a lofty level. In addition, India’s trade with the slowing China’s economy is limited.

In Latin America, the economic outlook is mixed. Countries like Brazil, Peru, and Chile are struggling with high inflation and interest rates. Their economic growth is hampered by reduced commodity exports to China and political instability. Mexico, however, stands out due to its strong economic ties with growing exports to the U.S.

Understanding the economic trajectories of these countries is crucial for investors.

Economic growth in large economies, such as China, can influence demand for commodities, impacting stock prices in sectors such as energy, mining, and agriculture.

Economic prosperity contributes to political stability, which is favorable for investment, while economic struggles can lead to unrest and negatively affect investor confidence.

In today’s interconnected global financial markets, economic events in one region can swiftly impact markets elsewhere.

Specific sectors, like technology or luxury goods, are particularly sensitive to economic changes in major markets such as the U.S., China, or Europe.

In summary, the interconnected nature of today’s global economy means that changes in one country’s economic growth can have wide-ranging direct and indirect effects on financial markets worldwide. Investors must consider various factors, including economic data, political events, and global market trends when making investment decisions.