A new service that connects renters’ monthly rent payments to their credit scores has entered the market, offering tenants a way to build credit through on-time rent history.

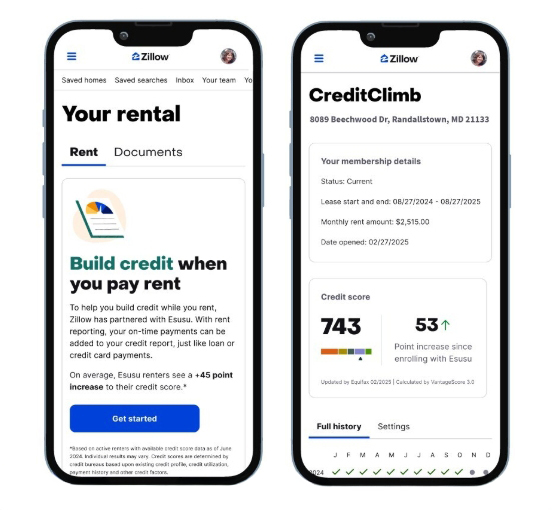

Zillow recently announced the launch of CreditClimb, a paid rent credit reporting service developed using technology from fintech firm Esusu. The service allows renters’ rent payment records to be reported to major credit bureaus, making rent credit reporting part of a tenant’s credit profile.

Founded in 2018, Esusu operates a rent data-based credit-building platform that covers more than 5 million rental units nationwide and serves over 12 million renters.

Under the program, renters pay an annual fee of $20, after which on-time monthly rent payments are automatically reported to Equifax, Experian, and TransUnion, the three major credit reporting agencies.

According to Zillow, renters who have already reported rent payments through the Esusu platform experienced an average credit score increase of 45 points. Zillow also estimated that rent reporting through the platform has helped improve access to more than $30 billion in mortgage financing.

Michael Sherman, senior vice president at Zillow, said CreditClimb is designed to help renters build credit using payments they already make. He added that the service can expand renters’ financial options, from securing future rental housing to eventually purchasing a home.

Beyond rent reporting, CreditClimb also provides credit score monitoring and allows renters to add up to two years of past rent payment history to their credit reports.

To enroll, renters verify their lease details and payment method. The reporting process is then handled directly by Zillow and Esusu.

Samir Goel, co-founder of Esusu, said credit access plays a critical role in financial stability and long-term opportunity, adding that the partnership aims to extend credit-building tools to more renters.

Despite rent being one of the largest monthly expenses for most tenants, about 87% of renters do not currently have their rent payments reported to credit bureaus. Lower credit scores can limit access to loans, favorable interest rates, and homeownership opportunities.

Earlier in 2024, Zillow introduced a free rent reporting option for users who pay rent directly through its platform. As a result, more than 147,000 renters were able to use their on-time rent payments to help build credit.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]