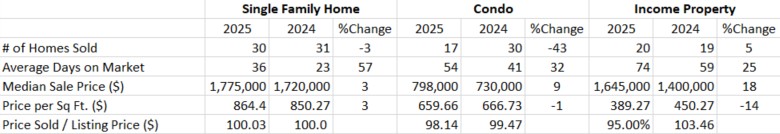

The number of homes sold in Koreatown fell by 16 percent in May 2025, with condo sales plunging by 43 percent compared to the same month last year, according to new data from Dream Realty.

The data from Korean American real estate broker Dream Realty, analyzed by the Korea Daily, shows that a total of 67 homes were sold in the Koreatown area in May, down from 80 homes in May 2024. While sales of single-family homes and income properties remained relatively steady, the steep decline in condo sales marked a significant shift in market activity.

Real estate professionals point to high mortgage rates and declining rental yields as factors driving investors away. “Many who previously purchased condos as rental investments are now hesitant or choosing to sell due to lower returns,” Dream Realty CEO Kenneth Jung explained.

A total of 30 single-family homes were sold in May, nearly unchanged from the 31 homes sold during the same month last year. Despite the high interest rate environment, demand for standalone homes in Koreatown remained consistent.

The median sale price for single-family homes was $1.775 million, up 3 percent from a year earlier. The average price per square foot also rose 3 percent to $864. Homes generally sold at the listed price, with a sales-to-list price ratio of 100.03 percent. However, homes took longer to sell, averaging 36 days on the market, compared to 23 days a year earlier.

Only 17 condos were sold in May, down from 30 condos a year prior—a 43 percent drop. Condos also took longer to sell, with an average of 54 days on the market, compared to 41 days in May 2024.

The median condo sale price rose 9 percent to $798,000, but most units sold for less than the asking price, with a sales-to-list price ratio of 98.14 percent. The average price per square foot held steady at $660.

Sales of income-producing homes, such as duplexes and apartment buildings, remained stable, with 20 units sold—just one more than the 19 units recorded in May 2024. The average days on market rose to 74 days, up 15 days from a year earlier.

The median sale price for income properties rose 18 percent to $1.645 million, but the price per square foot dropped 14 percent to $390, indicating buyers secured larger properties for less per square foot. The sales-to-list price ratio for this category was 95 percent, suggesting that price negotiations were common.

Kenneth Chung, president of Dream Realty, noted that while economic uncertainty is dampening buyer sentiment, there are also signs of a slight price correction. “This is typically a high-activity season between June and August,” he said, “so we’ll have to monitor how the market responds in the coming weeks.”

This Koreatown market snapshot covers ZIP codes 90004, 90005, 90006, 90010, 90019, 90020, and 90036.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]

![From Pulpit to Motorcade: How a Mega-Church Pastor Turned LAX Into His Personal Red Carpet Men in suits are directing traffic on the roadway in front of the Tom Bradley International Terminal at Los Angeles International Airport. Rev. Younghoon Lee is stepping out of a stopped vehicle. [Instagram capture from @joy.of.everything]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0206-pastor-2-100x70.jpg)