By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

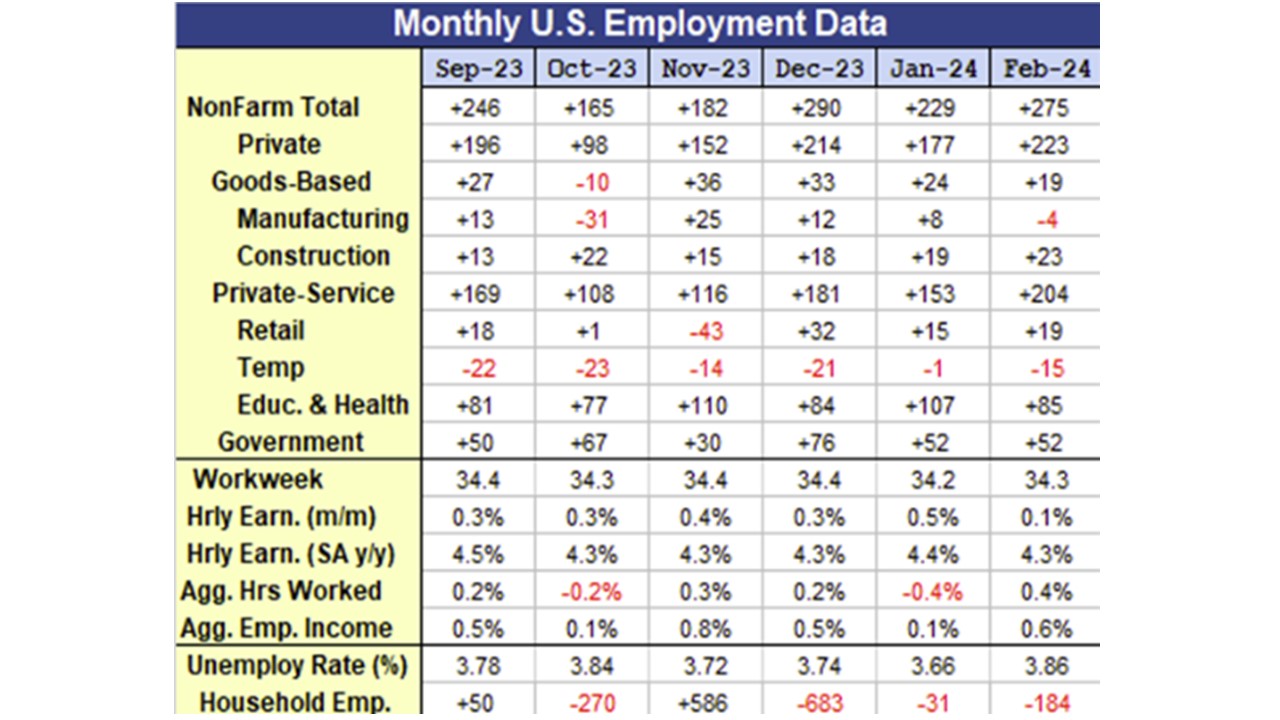

Even though the February job gain of 275,000 was higher than expected, the January and February numbers were revised down by 167,000 tempering growth. A separate household survey showed an average decline of 299,000 jobs per month over the previous three months. Another sign of slowing labor demand is temporary employment which has been declining for months.

The jobless rate increased to 3.9 percent from 3.7 percent during the prior month as more people looked for work. About 300,000 people rejoined the workforce during the month. The “Quit Rate,” has been falling as workers are less confident about finding new jobs and are choosing to stay in their current positions. As the labor market cools, wage gains have slowed.

A lion’s share of the job growth over the past year has originated from healthcare, government (social assistance), leisure and hospitality (food and drinking places) and construction (government-funded infrastructure). Other than leisure and hospitality, the employment gains have come from non-cyclical areas. Layoffs have surged to their highest level since the global financial crisis, as reported by Challenger, Gray & Christmas. This increase in layoffs is partly driven by technological advancements, such as artificial intelligence and digital transformation, which enhance operational efficiencies but reduce the demand for human labor.

The phenomenon of increasing layoffs despite a growing economy may appear contradictory but can be explained by several factors. While the economy expands overall, specific sectors may slow down due to cyclical trends or shifts in consumer demand. For example, the housing and mortgage industries have been negatively affected by high-interest rates, and there’s been a post-pandemic decrease in demand for various goods, from furniture to commodities. Many technology companies, in anticipation of economic downturns, have preemptively reduced their workforces, a typical approach in unpredictable industries.

The Federal Reserve is getting confirmation that it needs to cut the interest rate later this year. Federal Reserve Chairman Powell has expressed a desire to wait for more data before confidently easing policy restraints. Historically, such an approach has resulted in over-restraint of economic growth. The Federal Open Market Committee (FOMC) is advised to heed warning signs from reliable indicators like the inverted yield curve, the index of leading economic indicators and tightening bank lending standards that have been evident for a while.

Furthermore, the Real Federal Funds rate has reached levels that restrict economic activity. The nominal neutral rate, which neither stimulates nor hinders the economy, is currently around 2.5%, while the actual rate stands between 5.0% and 5.5%. This discrepancy suggests significant scope for reducing interest rates. By the time Chairman Powell and his colleagues are reassured by the data, the economy could already be experiencing excessive monetary tightening.

Before the release of this morning’s data, the CME FedWatch Tool estimated the likelihood of an interest rate cut in May at 21% and in June at 56%. Following the jobs report, the probabilities for rate cuts in May increased slightly to 29 percent and June have increased to 58 percent.