By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

Since the market hit its lowest point in October 2023, the S&P 500 index’s value has surged by over $9 trillion. The range of leaders within the stock market has expanded well beyond the so-called “Magnificent Seven” or the “Fantastic Five” (excluding Tesla and Apple), allowing the remaining 493 stocks to experience significant gains. Currently, over half of the S&P 500 index’s stocks have reached new 52-week highs. Furthermore, small-cap stocks, as represented by the Russell 2000, have outperformed the broader market. Throughout this year, companies involved with artificial intelligence continue to see remarkable growth, with Nvidia’s value increasing by approximately 80% and Super Micro’s by 250%.

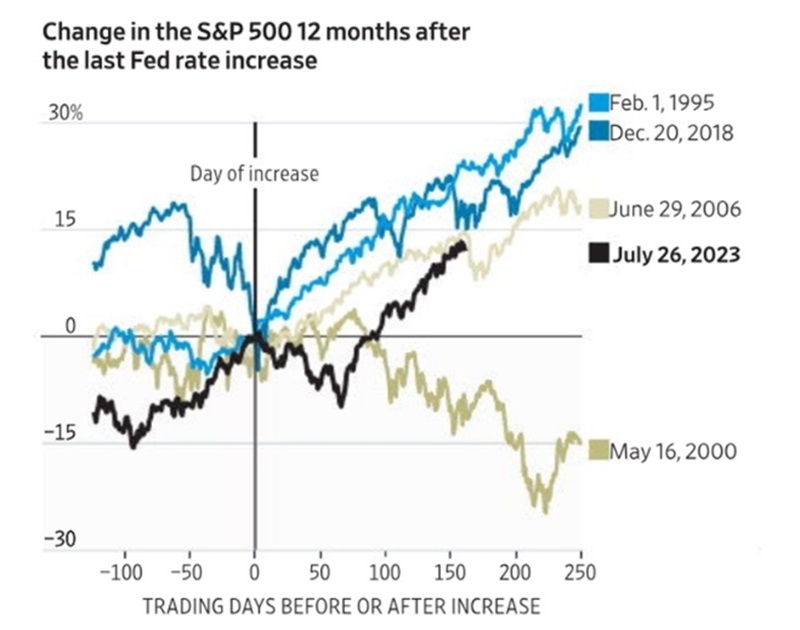

This favorable outcome can be attributed to a constellation of positive factors. Few investors are expressing concern over a potential recession, as the rate of inflation has been on a downward trajectory. The Federal Reserve is expected to reduce interest rates later this year. Corporate profits, which fundamentally drive the stock market, have exceeded expectations. Additionally, it is expected that bond prices will rise, resulting in lower yields. Decreased yields from bonds mean reduced competition from fixed-income securities, which benefits equities.

Despite this optimistic outlook, investors should remain vigilant for potential market volatility ahead. Historical analysis of the post-war era demonstrates that the stock market has experienced growth 86% of the time during periods of positive economic growth. However, the threat of an economic downturn or recession cannot be entirely dismissed, especially if the Federal Reserve keeps delaying interest rate cuts. Warning signs, such as an inverted yield curve, a decline in leading economic indicators, and stringent bank lending standards, have emerged as causes for concern.

Additionally, the economy and inflation are yet to fully absorb the impact of previous interest rate hikes. It often takes more than a year for the effects of monetary policy adjustments to permeate through the economy. The Federal Funds rate, once adjusted for inflation, appears too high, leading to disruptions in sectors such as housing, commercial properties, and capital spending. Econometric models suggest that the current interest rate is restrictive.

Moreover, the cooling of inflation has positively influenced both stocks and bonds. However, reducing the inflation rate to the 2% target from the current rate of about 3% has encountered what is known as “the last mile problem”. This challenge arises partly due to rising service prices (in sectors like healthcare, leisure, hospitality, and construction), which are linked to a tight labor market, union wage settlements, and increased minimum wages.

Despite the recent broadening, there is a need for further diversification in stock market leadership. The top 10 stocks still account for 34% of the S&P 500’s market value, a historically high concentration level. This issue of concentration is not confined to the U.S. but is also present in European and Japanese markets.

The bond market, in contrast, has not witnessed the same level of rally as the stock market. Once the Federal Reserve starts cutting the interest rate, bond yields are expected to decline. Historically, during periods of monetary easing by the central bank, the yield on 10-year bonds has fallen by 1.6 percentage points. This decrease would result in a 14% increase in the price of a 10-year Treasury note, from $10,000 to $11,408. The anticipated shift of $6 trillion from money market funds into longer-duration bonds and equities is likely to provide additional support. Bonds also offer the benefits of diversification and income, which become particularly valuable in the event of an economic downturn.

However, it is critical to remain cautious of unexpected events. Geopolitical tensions, ranging from the Middle East to North Korea and the Taiwan Strait, could introduce unforeseen challenges. Moreover, the burgeoning federal debt could maintain high-interest rates, negatively impacting both stocks and bonds. A further decline in the commercial property market could potentially instigate another regional banking crisis, along with its associated domino effects.