By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

Deciding whether to invest in a home in today’s fluctuating economic landscape is a dilemma faced by many millennials. Some have given up hope of ever owning a house. Since there is no need to save for a house, some are enjoying life spending money on dining out, designer clothes and traveling to exotic places. You can’t blame them for being spendthrift.

In Southern California, a starter single-family home easily costs over $2 million. The annual pre-tax income needed for mortgage payment and property taxes alone would be $209,109, not to mention additional expenses such as insurance and maintenance.

Conversely, other millennials are diligently saving to purchase a home, a more complex decision by current high-interest rates. The key question for potential buyers is whether to take the plunge now or wait. The Federal Reserve has hinted at future interest rate cuts, yet the timing remains uncertain.

Although mortgage rates may decrease, a significant drop is unlikely given the mind-boggling Federal government borrowing needs year after year. There is little chance that the mortgage rate will fall dramatically. In any case, lower rates will stimulate demand, further inflating property prices which, historically, have shown a steady long-term increase despite short-term volatility.

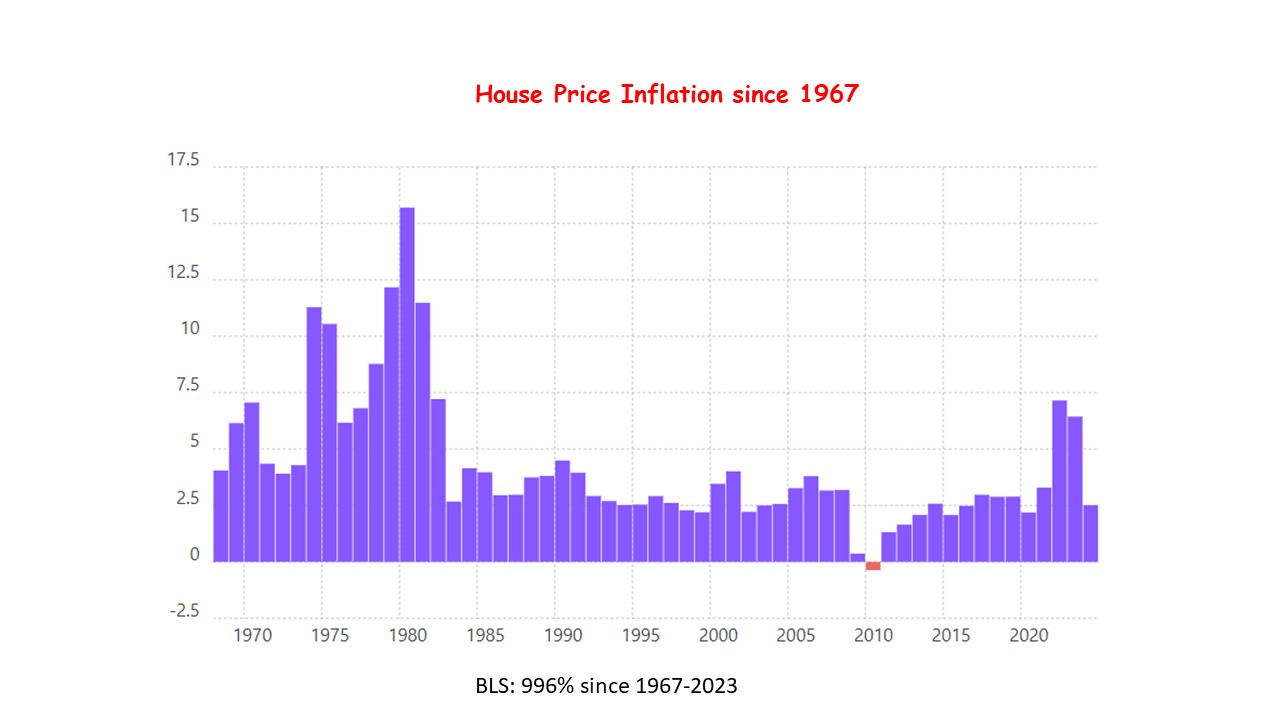

Homeownership has been one of the best inflation hedges. Over the past decade, house prices have outpaced inflation, with an average annual increase of 3.4% compared to the overall inflation rate of 2.72%, demonstrating the potential for homes to beat inflation.

The rising demand for housing, fueled by the formation of new households, is not matched by new construction. The housing shortage has been exacerbated by the “locked-in effect.” This refers to 80 percent of homeowners with mortgage rates below 5%. They are reluctant to sell and forfeit their low rates, further reducing the inventory of available homes and putting upward pressure on house prices.

Homeownership allows individuals to build equity through mortgage payments, with the potential for equity to increase as property values rise. Additionally, the recent stock market surge has enabled some millennials to enter the housing market more easily.

For those considering a purchase, an adjustable-rate mortgage (ARM) might be appealing if rates are expected to decline, allowing for future refinancing to a lower rate. However, this approach carries risks if rates do not fall as anticipated. A fixed-rate mortgage – if one can afford it – offers stability, consistent payments throughout the loan term, beneficial in a rising rate environment.

On the other hand, waiting to buy can provide advantages such as saving for a larger down payment, improving credit scores for better rates, and possibly a better deal.

Homeownership involves significant upfront costs and long-term financial commitments, from maintenance expenses to property taxes. Real estate is also less liquid than other assets, potentially limiting mobility. Since it is a sizable, long-term commitment, it is better to wait if one is not sure.

In summary, buying a home amid high but potentially declining interest rates involves weighing immediate financial burdens against the long-term benefits of homeownership and the opportunity for refinancing. It’s a highly personal choice, requiring careful consideration of one’s financial situation and the broader market trends.