By Sung Won Sohn

The author is professor of finance and economics at Loyola Marymount University and president of SS Economics. He was executive vice president at Wells Fargo Banks and senior economist on the President’s Council of Economic Advisors in the White House.

The Federal Reserve has concluded its interest rate increases. The ‘dot plot,’ a forecast by the 19 members who attended the December 12-13 FOMC meeting, predicts three quarter-point cuts in 2024, four in 2025, and three more in 2026, reducing the rate to a range of 2.25 to 2.5 percent. However, the $95 billion per month in ‘Quantitative Tightening’ will continue.

The statement noted, ‘Inflation has eased over the past year but remains elevated.’ Policy Makers are increasingly confident that inflation is under control, reducing the need for further interest rate hikes to curb it. However, they remain cautious about declaring victory too soon, fearing a potential resurgence of inflation.

According to the Fed’s forecasts, the core inflation rate is expected to be 3.2 percent in 2023, decreasing to 2.4 percent in 2024, 2.2 percent in 2025, and reaching the Fed’s target of 2 percent in 2026.

The Committee does not foresee a recession even though Chairman Powell pointed out that it can’t be ruled out. Economic growth is projected at 2.6 percent in 2023, half a percentage point higher than previously estimated. The growth rate for 2024 is expected to remain at 1.4 percent.

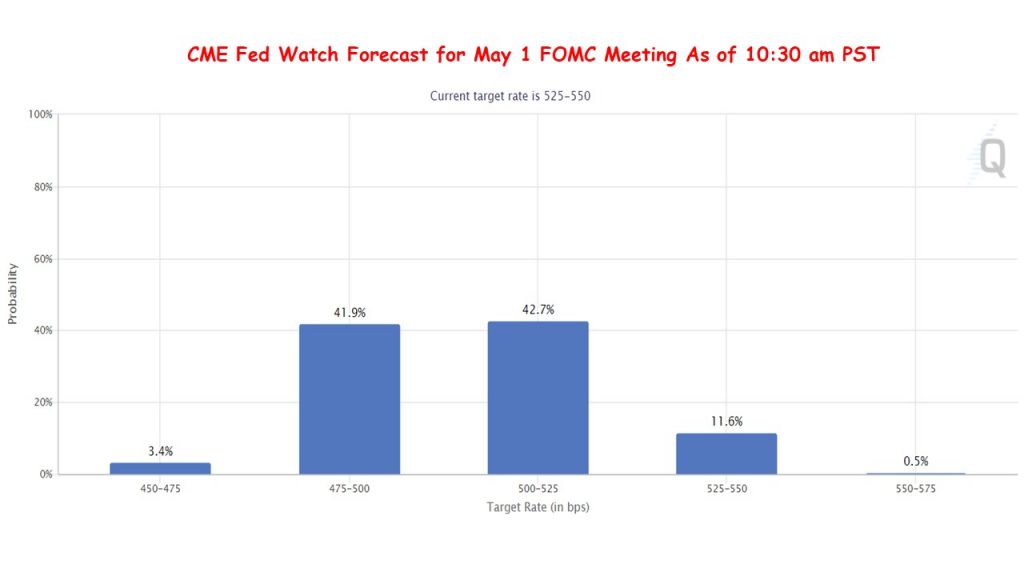

Upon hearing this positive news, both stock and bond markets surged. Investors, interpreting these signals of future monetary policy, are increasingly betting on interest rate reductions starting next spring. Just before today’s FOMC announcement, the CME Fed Watch Tool indicated a 78 percent chance of a 0.25 to 0.5 percent decrease in the interest rate by May 1. Following the announcement, market confidence in rate cuts has increased, with the likelihood now at almost 90 percent.

There’s a possibility that interest rates could fall faster than the FOMC and the CME Fed Watch predict. Prices for various goods, including appliances, used cars, and commodities, have been declining. The cost of shelter, accounting for 34 percent of the Consumer Price Index (CPI) basket, has been a significant inflation driver. Excluding the shelter component, November’s CPI increase would have been just 1.35 percent, instead of the reported 3.1 percent. As actual rents are decreasing, it is expected that this trend will soon be reflected in the CPI, leading to a lower inflation rate.

If prices drop quicker than anticipated, there’s a strong likelihood that the central bank might start lowering interest rates earlier and more rapidly than expected. This would be advantageous for the stock market. Historical data shows that following the Federal Reserve’s halt in interest rate hikes, the S&P 500 typically gains 6.9 percent in three months, 13.2 percent in six months, and 18.9 percent within a year.”