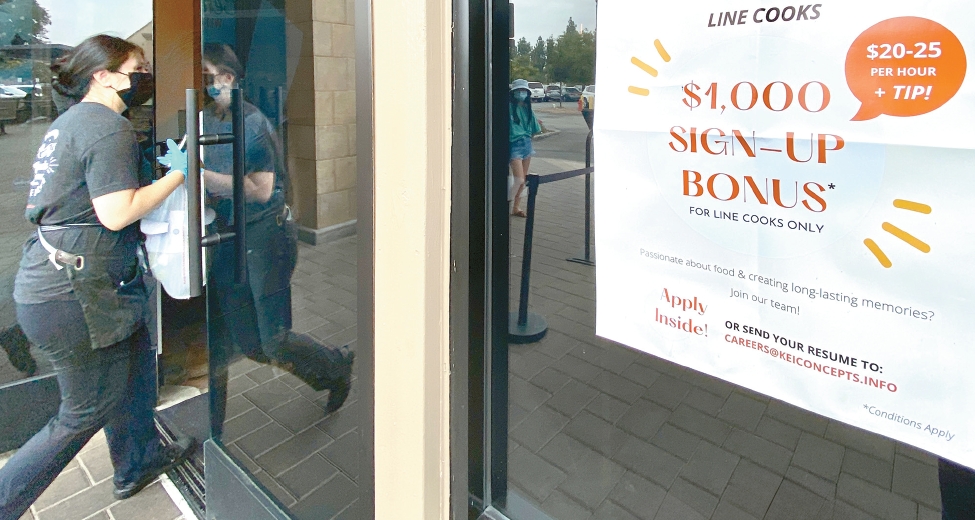

A proposed federal bill to exempt tip income from federal income tax is advancing in Congress, drawing both optimism and concern among Korean American business owners and accounting professionals.

The bill would exempt up to $25,000 in reported annual tip income from federal income taxes for workers in traditionally tip-based sectors, such as restaurants, salons, and hotels, beginning in 2025. The benefit would apply even without itemized deductions.

The legislation has already passed the Senate and is widely expected to clear the House, bolstered by strong Republican support and its status as a key campaign pledge of President Donald Trump. However, debates over its effectiveness and fairness continue to emerge.

Peter Sohn, a certified public accountant (CPA), said the bill’s benefits would likely be concentrated among service workers earning between $50,000 and $100,000 per year. He added that Uber and Lyft drivers may see limited gains since many already deduct vehicle-related expenses.

Although the bill aims to support low-income workers, critics argue that many of those workers won’t see real tax relief. Many already owe no federal income tax due to the standard deduction. According to Internal Revenue Service (IRS) data, about 37% of tipped workers don’t currently pay federal income tax, meaning nearly one-third may not benefit at all.

A New York Times example illustrated this gap: a college student earning $18,000 over the summer as a waiter would save just $250. Meanwhile, a Las Vegas casino dealer making $60,000 in tips could reduce their tax bill by more than $10,000. However, workers earning above $160,000 annually are excluded from the bill entirely.

Reactions Vary by Industry and Worker Experience

Among Korean American business owners, reactions differ by industry. Owners of Korean restaurants and beauty salons say the exemption could help attract and retain workers. But others, such as garment factory or office employers, worry about fairness.

One Korean American business owner, who asked not to be named, said, “If someone earning $40,000 pays less tax just because they work in a restaurant, while my employee pays full tax, there’s naturally going to be resentment. It might also become harder to hire workers if more people shift to tip-based jobs.”

Many tipped workers welcome the proposal but remain cautious. David Lee, a restaurant manager in Cypress, said, “It’s great that tips would be tax-exempt, but there’s a risk employers might lower base pay or customers might tip less. We’ll have to see how it plays out in reality.”

The bill is currently scheduled for limited implementation through 2028, with the possibility of extension depending on future political dynamics and the federal budget outlook.

BY WONHEE CHO [cho.wonhee@koreadaily.com]

![Family of army veteran killed in San Antonio shooting launches fundraiser A screenshot of the GoFundMe fundraising page created for Kyung Chang Lee. Donations are being collected to support the family of Lee, who was killed in the San Antonio, Texas, shooting. [GoFundMe capture]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0225-KyungChangLee-100x70.jpg)