Are LG Household & Health Care and Amorepacific still the top representatives in the Korean cosmetics industry? For beauty enthusiasts in 2024, the answer might have changed. Companies like Cosmax and Kolmar Korea, manufacturing partners for numerous small to medium-sized beauty brands, are now gaining significant recognition.

Before collaborating with smaller brands, these two companies were already partners with global giants. On the packaging of products from brands like Lancôme, Yves Saint Laurent, Estée Lauder, MAC, and La Mer, you’ll often find Cosmax or Kolmar Korea listed as the manufacturers.

Kolmar Korea introduced the concept of Original Development Manufacturing (ODM) in the Korean cosmetics industry, and Cosmax now develops and produces products for 18 of the world’s top 20 beauty companies, making them pillars of K-beauty. But how did these companies, whose names are only visible when you flip the product, come to dominate the global market?

The hidden powerhouses of K-beauty

K-beauty is highly popular on Amazon, the world’s largest e-commerce platform. Influenced by the Korean wave and social media platforms like YouTube and TikTok, global hit products from small and medium-sized cosmetics companies are continually emerging. Products like Beauty of Joseon Sunscreen, I’m From Rice Toner, and TIRTIR Cushion sell out quickly during discount periods. Cosmax and Kolmar Korea, the manufacturers behind these products, are quietly enjoying this trend.

Only a few major Korean companies, such as LG Household & Health Care, Amorepacific, and Aekyung Industry, can handle product development, production, and distribution entirely on their own. Small to medium-sized brands without their own production facilities focus on product planning and marketing, outsourcing product development and manufacturing to Original Design Manufacturers (ODMs).

Unlike Original Equipment Manufacturers (OEMs), which focus solely on production, ODMs develop products and propose them to clients. ODMs possess various patented technologies and have a keen understanding of beauty trends, enabling them to turn small brands’ ideas into reality.

K-beauty’s growth fueled by ODM

In addition to Cosmax and Kolmar Korea, which are ranked among the top three global ODMs along with Italy’s Intercos, other Korean companies like C&C International and Cosmecca Korea are thriving in the K-beauty trend. These companies are responsible for developing and producing products not only for Korean brands but also for brands across the U.S., China, Japan, and beyond.

For instance, C&C International manufactures products for Rare Beauty, a cosmetics brand created by pop star Selena Gomez that has gained popularity among American teenagers, achieving record sales of 63.1 billion won ($45.8 million) last year.

The ODM industry requires sophisticated chemical technology and a high degree of trust in safety, making it difficult for Chinese companies to compete. The ODM industry in countries like the U.S., Italy, and Japan, where the concept originated, has virtually declined due to the specialization and division of labor within the beauty industry. Korean ODM companies have now become the research labs and factories of the global beauty sector.

“As researchers from large corporations like LG Household & Health Care and Amorepacific moved to emerging companies, the production standards of K-beauty companies have been raised,” said Park Jun-sung, a professor in the Department of Chemical Engineering at Chungbuk National University and former researcher at Amorepacific. “Foreign brands have recognized the quality of Korean cosmetics, leading to the growth of the domestic ODM industry.”

Professor Kim Ju-deok of the Department of Beauty at Sungshin Women’s University, who worked at LG Household & Health Care, added, “Thanks to about 4,700 domestic cosmetics manufacturers competing technologically, Korean cosmetics have now become a strong export product. With the K-beauty boom, the technological capabilities have improved, and the market base has expanded.”

In the early 2010s, Korea’s cosmetics exports, which were in the 2 trillion won range, increased to about 11 trillion won last year. Unlike in the past when a few major companies led exports, the rise of small brands has played a significant role. Last year, small and medium-sized K-beauty companies achieved record exports of $5.4 billion (about 7 trillion won), marking the highest in the history of cosmetics exports for this sector.

Similar growth trajectories

In the 1990s, when the cosmetics industries in the U.S. and Japan were far ahead of Korea, Kolmar Korea and Cosmax introduced the division of sales and development/manufacturing systems to Korea for the first time. Both companies have similar beginnings and growth stories.

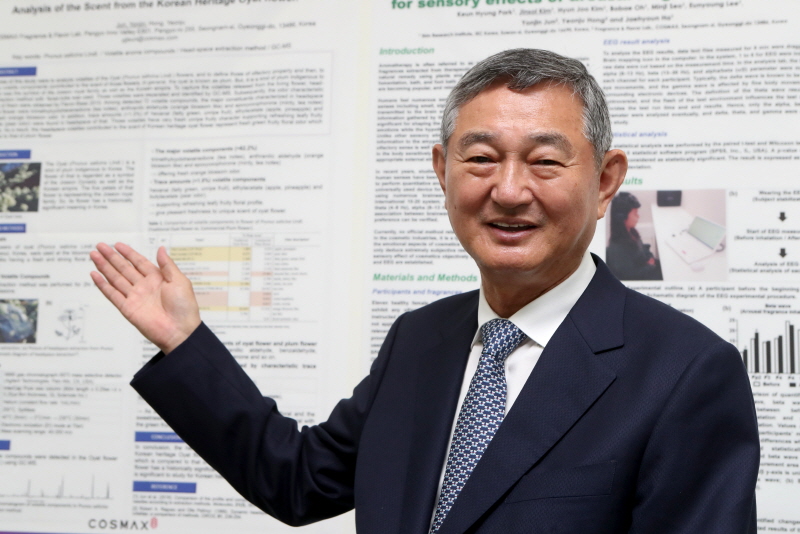

Both founders, Yoon Dong-han (77) of Kolmar Holdings and Lee Kyung-soo (78) of Cosmax Group, are from Daewoong Pharmaceutical. Chairman Yoon joined Daewoong in 1974 and served as Vice President before establishing Kolmar Korea in 1990. Chairman Lee joined Daewoong in 1981 and left his position as Executive Director of Marketing in 1992 to found Korea Milotto (the predecessor of Cosmax).

Their research methods and quality control standards are similar to those of the pharmaceutical industry. Kolmar Korea introduced Good Manufacturing Practices (GMP) standards from the pharmaceutical industry into cosmetics (CGMP) in 1994, and Cosmax received the same certification in 1998. They also invest 5 to 7% of their sales in R&D, reflecting their pharmaceutical DNA.

Both companies started by partnering with Japanese firms. Kolmar Korea began as a joint venture with Japan’s Kolmar, producing toner, a popular product of Japan Kolmar. In 2022, Kolmar Korea acquired the Kolmar brand entirely, making it the only Kolmar in the world.

Cosmax started with a technology partnership with Japan’s Milotto and then went independent in 1994 after Milotto opposed Korea Milotto’s operation of its own research lab. Cosmax built expertise in producing color cosmetics, which had high global OEM demand.

Diverging paths

The twin-like paths of these two companies started to diverge relatively recently. In February 2018, Kolmar Korea acquired CJ Healthcare (now HK Inno.N) for 1.31 trillion won, aiming to grow as a comprehensive healthcare company based on cosmetics and pharmaceuticals. Vice Chairman Yoon Sang-hyun of Kolmar Korea announced plans to succeed in new drug development within ten years and become a top five global pharmaceutical company. That same year, Cosmax also acquired Twin Pharma (now Cosmax Pharma), which produces raw materials for pharmaceuticals and cosmetics, but remains focused on cosmetics.

Since the 2000s, Kolmar Korea, which had fallen behind Cosmax, diversified its business. The acquisition of CJ Healthcare established a foundation in pharmaceuticals and biotechnology and boosted its dietary supplement business. HK Inno.N grew the market for its hangover cure product “Condition” and beverage “Hutgae Water,” recording sales of 828.9 billion won last year, accounting for about 40% of the group’s total sales (2.15 trillion won). Kolmar Korea is also actively pursuing M&As for vertical integration in its cosmetics business.

Cosmax turned its sights abroad early. After scouting global beauty exhibitions, they secured a contract with L’Oréal in 2004, which was a significant growth milestone. The world’s number one L’Oréal conducted a two-year review of production facilities and quality control before contracting with Cosmax, highlighting their high standards. In the same year, Cosmax entered the Chinese market, becoming a preferred partner for developing and producing small quantities of high-quality, affordable products in a market flooded with low-quality, low-cost local brands.

By 2013, Cosmax acquired L’Oréal’s factories in Indonesia and the U.S., expanding its clientele to North America, Southeast Asia, and further into Mexico and Brazil. With ODM sales of 526.8 billion won in the first quarter, Cosmax outpaces Kolmar Korea (299.9 billion won) as the global number one.

Cosmax is also enhancing its R&D. Following the internal organizational restructuring, they established a joint research lab for cosmeceuticals with Dankook University in January.

The cosmetics battle: who wins?

After ceding the domestic color cosmetics market to Cosmax, Kolmar Korea focused on sun care products. Currently, Kolmar Korea produces seven out of ten sunscreen products in Korea. They rapidly entered the U.S., the largest sun care market globally, achieving a market share of 17.6%. In the U.S., products containing sunscreen are classified as over-the-counter (OTC) drugs, and Kolmar Korea was the first in the Korean industry to receive FDA OTC drug certification in 2013.

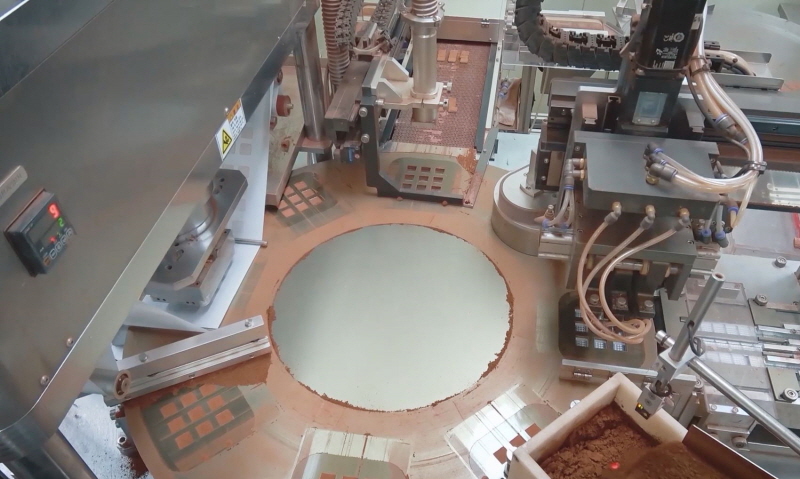

Cosmax, the color cosmetics leader, recently introduced an AI color-matching system to speed up production. Adjusting pigment types and concentrations to achieve the desired color is the most time-consuming step in developing makeup products. Cosmax’s AI system, trained with accumulated color information, allows researchers to see color-matching results without conducting experiments.

If ODM companies that excel in product development, production, and beauty trends launched their own cosmetics brands, would they succeed? Both Cosmax and Kolmar Korea officially state they have no plans to develop their own brands, despite having some in existence.

However, experts have different views. Professor Kim Ju-deok of Sungshin Women’s University predicts, “While they may not actively pursue it now due to existing clients, they could aggressively promote their brands when the time is right.”

Other contributors to the K-beauty boom

While Cosmax and Kolmar Korea handle product development and production for indie brands behind the scenes, platforms like Olive Young and Silicon2 connect these indie brands to consumers.

Olive Young, with its 1,338 offline stores (as of last year), connects consumers to high-quality small brands. Among over 20,000 Olive Young products, 80% are from small and medium-sized domestic companies. Olive Young’s dominance in the domestic health and beauty market signifies that popularity on this platform translates to popularity in the Korean beauty market. Last year, 51% of brands that achieved annual sales of over 10 billion won on Olive Young were small domestic brands, with Clio and Round Lab surpassing 100 billion won in sales.

Silicon2 connects international consumers with K-beauty indie brands. Initially starting as a memory semiconductor export company in 2002, it now operates the online platform “Stylekorean.com,” selling products from over 570 Korean cosmetics brands to 180 countries wholesale and retail. The cosmetics division, established in 2012, has grown significantly due to the K-beauty boom, changing the company’s primary business. Last year, the business distribution was cosmetics wholesale exports (79%), reverse direct purchase (5%), and export support fulfillment for small brands (15%).

BY KYUNGMI KIM, SUJEONG LEE, YOUNGNAM KIM [gaem@joongang.co.kr]