California Housing Finance Agency (CalHFA) has launched a new program that provides up to $20,000 in mortgage assistance to homeowners whose properties were damaged or destroyed by wildfires or winter storms between January 2023 and January 2025.

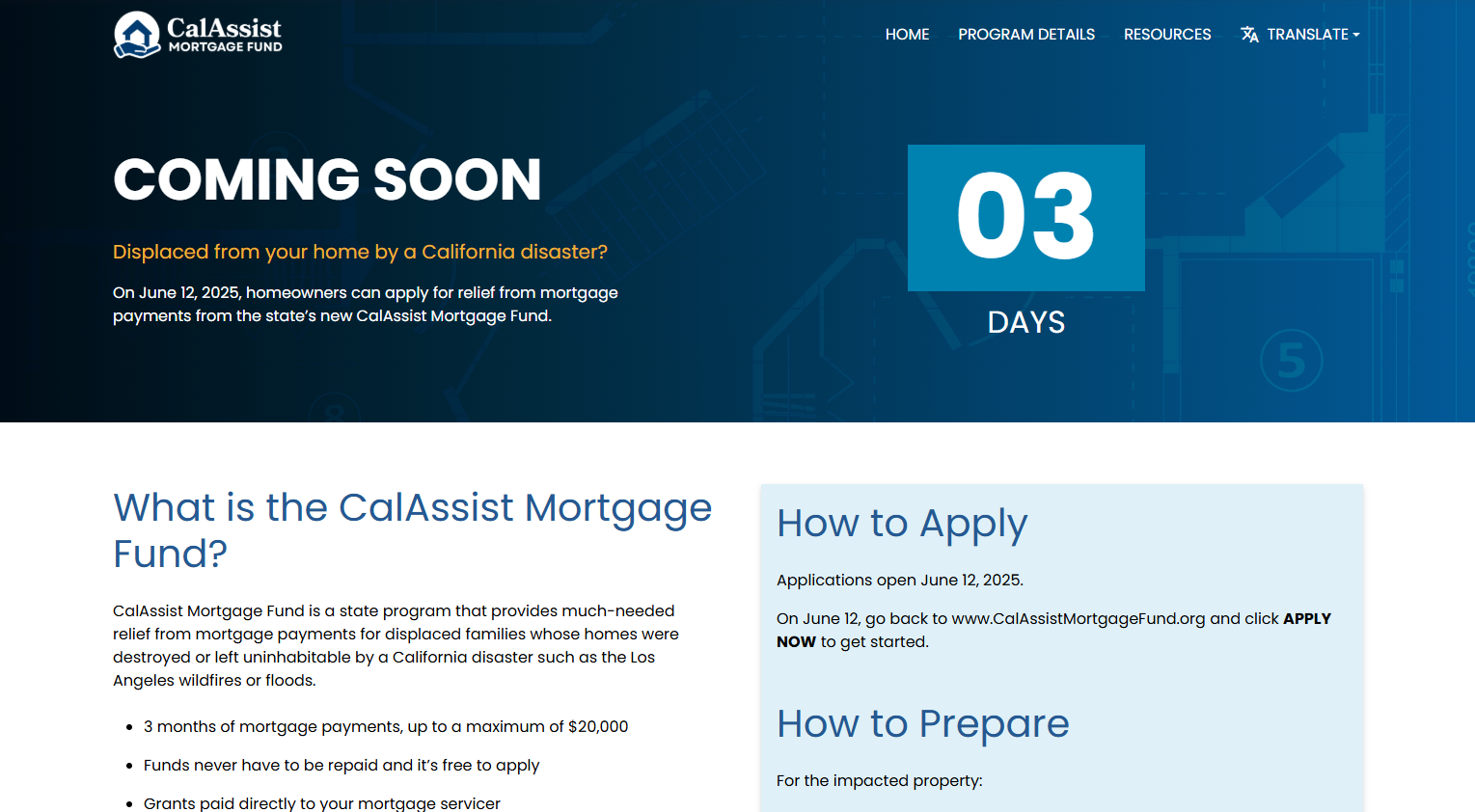

The CalAssist Mortgage Fund, which opens on June 12, offers aid equivalent to three months of mortgage payments, capped at $20,000. The funds will be paid directly to mortgage servicers and are fully forgivable—recipients will not need to repay the amount.

The program is open to eligible applicants on a first-come, first-served basis until the $100 million budget is exhausted.

Eligibility Based on Damage and Income

To qualify, applicants must own a residential property that became uninhabitable due to a qualifying disaster during the stated period. Events include the Eaton Fire and Palisades Fire. The property must have an active mortgage or reverse mortgage.

Applicants must also meet income limits. In Los Angeles County, the maximum eligible household income is $140,700.

Only mortgages serviced by participating lenders are eligible. Major institutions currently enrolled in the program include Chase, Bank of America, and the U.S. Department of Agriculture (USDA).

How to Apply and Required Documents

Homeowners must first confirm that their disaster event is listed on the official site and verify that their lender participates in the program. This information is available at CalAssistMortgageFund.org.

The application requires documentation including:

- Mortgage statement

- Bank transaction history

- Utility bills

- FEMA or insurance claims

- Proof of income

Applicants who need assistance can call (800) 501-0019 to schedule in-person support.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]