Hyundai, Kia, and Genesis are among the most familiar auto brands in Korean American communities. A new online survey shows that Korean car preference remains strong among Korean Americans, though preferences vary widely by age and income.

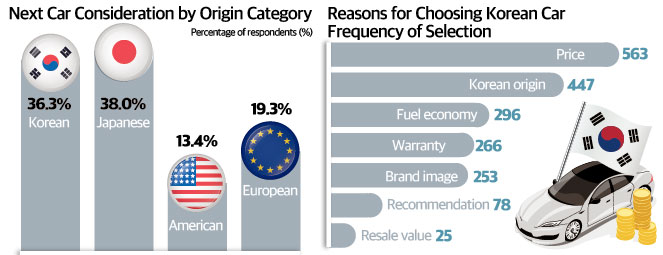

According to the 2025 Korean Car Preference online survey by the Korea Daily’s ResearchON, 36% of respondents said they would consider a Korean vehicle for their next purchase. While 38% said they would choose Japanese brands such as Toyota or Honda, the gap is narrow compared with earlier periods when Japanese automakers held a dominant lead.

The findings point to a meaningful shift in perception. Korean brands are no longer viewed solely as alternatives but are now competing closely with established Japanese models in consideration rates.

Currently, 968 respondents (40%) reported owning a Korean vehicle. Among them, Hyundai accounted for the largest share with 604 owners (62%), followed by Kia with 267 (28%), and Genesis with 97 (10%).

When asked why they chose Korean cars, the most common response was affordability, cited by 58.1% of owners. This was followed by brand identity — “because it is a Korean car” — at 46.2%. Other factors included fuel efficiency (30.6%), warranty coverage (27.5%), and overall brand image (26.1%). The results indicate that price competitiveness and trust in Korean brands remain the two central drivers of purchase decisions.

Age differences were particularly pronounced. Among respondents under 30, 79% cited price as the main reason for choosing a vehicle, while 73% of those in their 30s also pointed to affordability. In contrast, respondents aged 60 and older were far more likely to say they preferred Korean cars simply because they were Korean brands, reflecting emotional attachment and long-standing trust.

These generational differences were also evident in future purchase intent. Among respondents aged 60 and older, 42.6% said they were likely to purchase a Korean vehicle in the future. The figure dropped to the low 30% range among younger groups. Respondents in their 30s reported a 38.6% likelihood, while those under 30 showed the lowest intent at 30.5%.

Income levels also influenced preferences. Among households earning less than $50,000 a year, 43.8% said they would consider Korean cars. Those earning between $50,000 and $100,000 showed a similarly high preference at 37.4%, both above the overall average.

By contrast, only about 31% of respondents with annual incomes of $150,000 or more expressed interest in Korean vehicles. The survey suggests that higher-income consumers tend to shift attention toward European brands, luxury SUVs, or premium offerings such as Genesis rather than mainstream Korean models.

Taken together, the results show that Korean cars hold a solid position in the Korean American market, supported by both practicality and cultural identity. However, the data also indicate that future growth will depend on how effectively Korean brands appeal to younger consumers, who increasingly weigh price and design over national origin.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]

![“LA’s homelessness policy is broken” Katy Yaroslavsky, a Los Angeles City Council member (center), speaks about addressing homelessness and strengthening public safety at a press conference on January 29. [Kyeongjun Kim, The Korea Daily]](https://www.koreadailyus.com/wp-content/uploads/2026/01/0130-Yaroslavsky-100x70.jpg)

![Los Angeles unveils time capsule buried 100 years ago Materials from the time capsule are now on display in the lobby of the Los Angeles Central Library. [Sangjin Kim, The Korea Daily]](https://www.koreadailyus.com/wp-content/uploads/2026/01/0130-timecapsule-1-100x70.jpg)