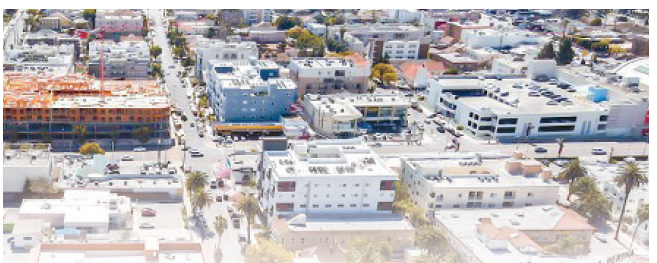

The Los Angeles Koreatown housing market, which had been entering a recovery phase, showed an overall adjustment as both transaction volume and prices softened from a year earlier. Sales fell across single-family homes, condominiums, and rental-income properties, and key price indicators also declined.

A total of 60 homes were sold in Koreatown last month, down 13% from 69 homes in the same month last year. Transaction counts fell for single-family homes, condos, and rental-income properties.

The analysis is based on data provided by Dream Realty, led by Kenneth Jung, and compares home sales in Koreatown during the same period this year and last year. SeetableSee table

Real estate professionals said, “As interest rate cuts continue, buyers are taking a wait-and-see approach while holding out for further price adjustments,” adding, “Seasonal factors tied to the winter off-season also overlapped, which appears to have contributed to the decline in sales.”

Last month, 27 single-family homes were sold in Koreatown, a 7% decrease from 29 homes a year earlier.

The median sale price was $1.5 million, down 15% from $1.765 million last year. The average time on the market was 28 days, a 32% decline from 41 days a year earlier, which was analyzed as a sign that basic demand has become firmer. The average price per square foot fell 10% to $770.55, compared with $854.23 last year. Homes sold for 98.69% of their listing price, slightly lower than 99.47% a year earlier. This was interpreted as faster deals concentrated in listings that had already undergone price adjustments.

The slowdown was more pronounced in the condo market. Twenty condos were sold last month, down 13% from 23 a year earlier. The median sale price plunged 25% to $655,000, from $875,000 last year.

The average time on the market rose to 81 days, up 103% from 40 days a year earlier, showing delayed transactions. The average price per square foot slipped 10% to $604, compared with $673.07 last year. Condos sold for 98.22% of their listing price.

Sales of rental-income properties were also weak. Thirteen rental-income properties sold last month, down 24% from 17 a year earlier. The median sale price was $1.425 million, down 2% from $1.46 million last year.

The average price per square foot fell 12% to $383, compared with $437 last year. The average time on the market increased 33% to 60 days, from 45 days a year earlier, and the sale-to-list price ratio declined to 94.89%.

Industry sources said, “Recently the condo and rental-income property markets have seen buyers grow more cautious as multiple burdens overlap, including maintenance and management costs and property taxes.”

Kenneth Chung, head of Dream Realty, said, “Price adjustments are happening broadly, but the balance between demand and supply is still being maintained,” adding, “For the time being, the key variable in the market will be whether prices stabilize, rather than transaction volume.”

This Koreatown housing market analysis covers ZIP codes 90004, 90005, 90006, 90010, 90019, 90020, and 90036. As a result, trends may differ from those in other parts of Koreatown.

BY HOONSIK WOO [woo.hoonsik@koreadaily.com]

![U.S. arrivals face hourlong immigration waits at Incheon Airport Incheon International Airport’s Terminal 2 is crowded with arriving passengers on Jan. 30. [Courtesy of reader]](https://www.koreadailyus.com/wp-content/uploads/2026/02/0217-Incheon-100x70.jpg)