Comprehensive analysis of six major banks’ Q3 results shows strong gains in total assets, loans, and deposits; Bank of Hope rebounds sharply amid cost savings and improved credit quality

Southern California’s leading Korean American banks continued their upward momentum in the third quarter of 2025, recording robust growth across key financial indicators.

Combined net income for the six major institutions surged 33% year-over-year, supported by expanding loan portfolios, rising deposits, and disciplined cost management.

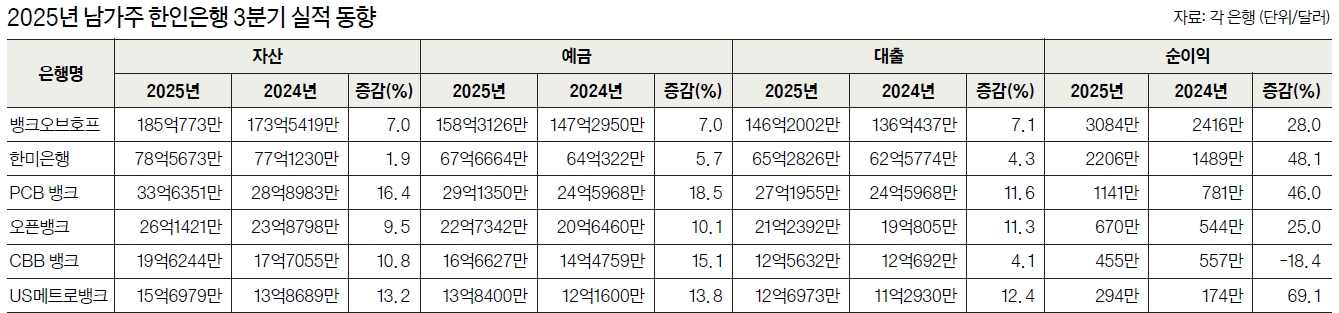

Total Assets Climb to $35.87 Billion — Up 7.1% YoY

The six major banks — Bank of Hope, Hanmi Bank, Open Bank, PCB Bank, CBB Bank, and US Metro Bank — reported a combined total asset balance of $35.87 billion, up from $33.50 billion a year earlier, marking a 7.1% annual increase.

By institution:

Bank of Hope: $18.51 billion (+7%)

Hanmi Bank: $6.53 billion (+1.9%)

PCB Bank: $3.36 billion (+16.4%)

Open Bank: $2.72 billion (+9.5%)

CBB Bank: $1.77 billion (+10.8%)

US Metro Bank: $1.57 billion (+13.2%)

PCB Bank led the growth among mid-sized institutions with a double-digit surge in assets, while US Metro Bank also recorded notable quarterly expansion.

Deposits and Loans Continue to Strengthen

Deposit growth remained solid across most institutions.

PCB Bank surpassed $2.9 billion in deposits, up 18.5% year-over-year.

CBB Bank and US Metro Bank also saw gains of approximately 15% and 13%, respectively.

Combined loans among the six banks reached $28.52 billion, compared to $26.50 billion a year earlier — a 7.6% increase.

US Metro Bank stood out with $1.27 billion in total loans, up 12.4% from the prior year, followed by PCB and Open Bank, which both expanded lending by more than 11%.

Average Net Income Rises 33% — A Broad-Based Recovery

Collective third-quarter net income reached $78.5 million, sharply higher than $59.6 million in the same period last year.

Breakdown by institution:

Bank of Hope: $30.8 million (+28%)

Hanmi Bank: $22.1 million (+48%)

Open Bank: $11.4 million (+46%)

PCB Bank: $11.3 million (+46%)

CBB Bank: $4.55 million (–18%)

US Metro Bank: $2.94 million (+69%)

US Metro Bank posted the strongest gain among peers, while Hanmi and PCB also reported robust double-digit increases. Bank of Hope rebounded sharply after a loss in the previous quarter.

Bank of Hope’s Strong Rebound

Bank of Hope (CEO Kevin Kim) posted a net income of $30.8 million ($0.24 per share) for Q3 2025 — up 28% year-over-year and a complete turnaround from a $27.9 million loss in Q2.

The earlier loss had stemmed from securities portfolio restructuring, the Territorial Bancorp acquisition, and changes in California’s tax law.

“Net interest income rose 8% quarter-over-quarter — the strongest momentum we’ve seen in three years,” said CEO Kevin Kim.

“Lower funding costs, diversified loan growth, and improved asset quality all contributed to a significant increase in profitability.”

The company also announced a $0.14 per share quarterly dividend, payable November 21.

Outlook: Continued Expansion into 2026

Financial analysts note that Korean American banks have entered a “sustainable growth phase,” combining conservative credit practices with stable net interest margins.

A senior banking source commented, “With rate stabilization and steady business lending demand, we expect the profit growth trend to extend into early 2026.”

Most banks are now focusing on digital banking, small-business lending, and community-based commercial services, positioning themselves for steady performance even amid an uncertain economic outlook.

![“LA’s homelessness policy is broken” Katy Yaroslavsky, a Los Angeles City Council member (center), speaks about addressing homelessness and strengthening public safety at a press conference on January 29. [Kyeongjun Kim, The Korea Daily]](https://www.koreadailyus.com/wp-content/uploads/2026/01/0130-Yaroslavsky-100x70.jpg)

![Los Angeles unveils time capsule buried 100 years ago Materials from the time capsule are now on display in the lobby of the Los Angeles Central Library. [Sangjin Kim, The Korea Daily]](https://www.koreadailyus.com/wp-content/uploads/2026/01/0130-timecapsule-1-100x70.jpg)