A number of businesses in Los Angeles County still have not applied the new sales tax rate, according to the Korea Daily’s findings.

Starting from Jan. 1, the sales tax rate in L.A. County has decreased by 0.25 percent—from the previous 9 to the current 8.75 percent. The new rate was triggered as the part of the plan after Proposition 30 was voted in to raise funds for public education.

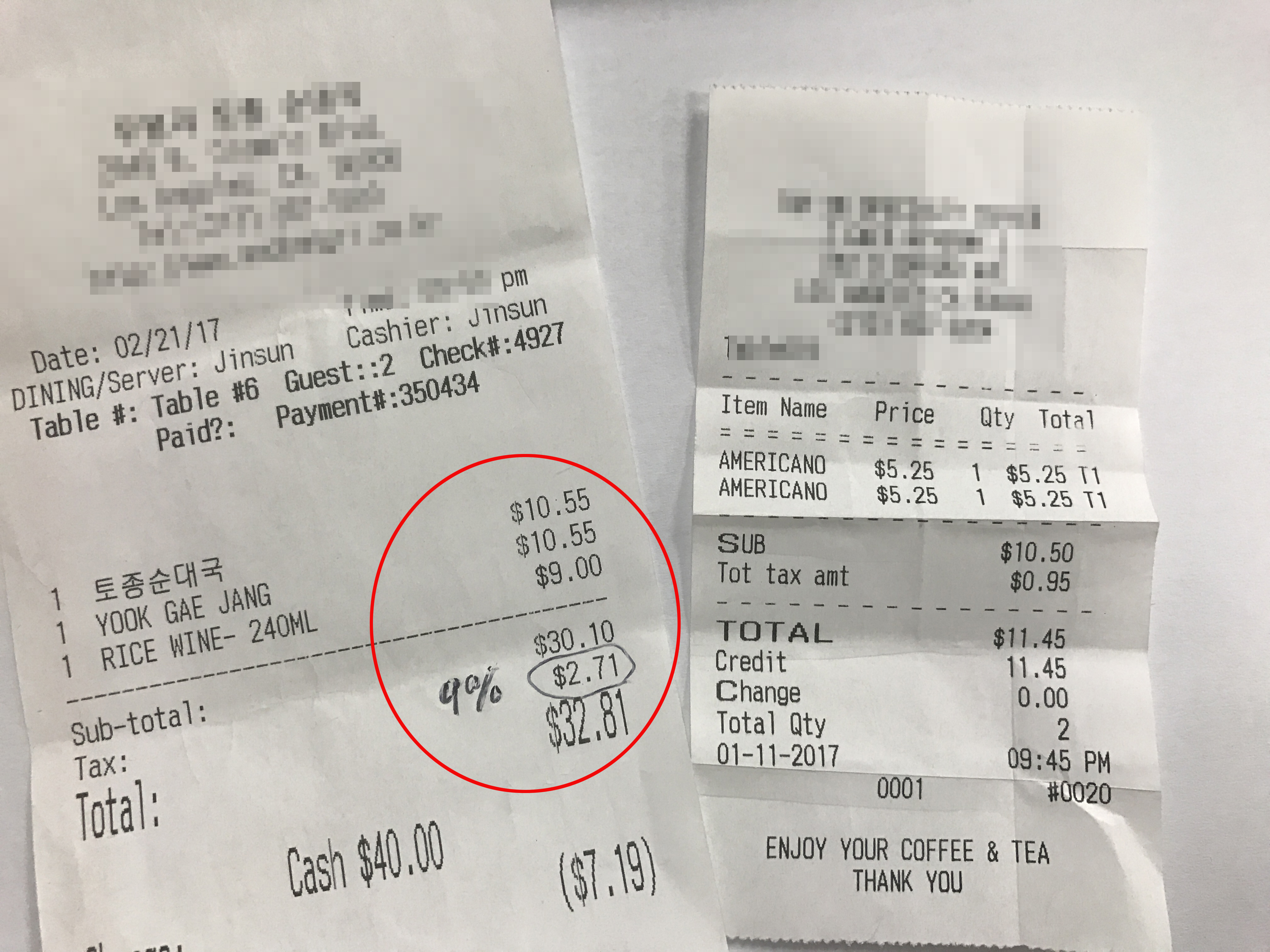

A businessman in L.A., only identified by his last name Lee, visited a restaurant in Koreatown back in January. He was a bit taken aback after receiving the check from his server as he was charged a total of $23 with a $1.90 tax for two bowls of soup.

“I’m a businessman, so I notice it right away when the tax is not imposed correctly,” Lee said. “The tax rate on the receipt was 9 percent. It seemed like they had no idea about the change, so I let their employee know. He told me that they’ll make the correction.”

However, Lee said he visited the restaurant several times after that incident only to see that the change was never made despite his repeated efforts to get the message across.

The restaurant owner explained to the Korea Daily that the erroneously imposed tax rate was due to the troubles of its Post of Sale (POS) system.

“I’ve tried making the change on our POS system,” he said. “Maybe our system is too old, but I couldn’t make the change.”

The restaurant owner added that the total cost that the customer would have to pay including the sales tax will not be changed. His explanation was that he prefers to fix the price of yukgaejang (spicy beef stew) at $11.50 for the “convenience of the customers.”

But that also means that the restaurant plans to increase the price of its yukgaejang to $10.58 per bowl to keep the total cost at $11.50 with or without the change in sales tax.

“Regardless of whether or not the restaurant owner decides to change the price of its menu, imposing a 9 percent sales tax on the receipt is not lawful,” said Koreatown-based public accountant Ki-wook Um.

A café in Koreatown was also recently revealed to have been insistent on imposing a 9 percent tax rate despite the change.

“I had no idea about the change,” the café owner said. “Now that I know, I’ll make the change immediately. The customers will be refunded if they bring their receipts.”

Likewise, many business owners across Koreatown are openly admitting that they have been oblivious to the change in sales tax. In most cases, the business owners learn about tax-related policies from their accountants as there are no separate announcement made from the State Board of Equalization. Additionally, many business owners are left in confusion as the sales tax rate has changed frequently over the last few years.

Case in point, the sales tax rate in L.A. County is set to rise again to 9.25 percent from July 1.

By Soo Yeon Oh